Mach dein Ding, wir

Behalte den Überblick mit Deutschlands modernster Steuerberatung für Selbstständige. Unsere Kombi aus Steuerprofis und Nutzung der Kontist App macht dir das Leben leichter. Starte noch heute.

Klicke einfach auf den Aktivierungsbutton und nimm noch heute über das Formular Kontakt mit uns auf.

Überlass das Finanzamt uns – wir vertreten dich in deinem Interesse

Wir erhalten deine Post vom Finanzamt und kommunizieren mit der Behörde bei Bedarf.

Wir melden uns bei dir, wenn du aktiv werden musst.

Auf deinen Wunsch übersetzen wir das Bürokratendeutsch in verständliche Sprache.

Vereinfache deine Buchhaltung – mehr Zeit für das, was wirklich zählt

Experten*innen bearbeiten deine Buchhaltung.

Deine Umsatzsteuervoranmeldungen werden fristgerecht eingereicht.

Behalte die Übersicht über deine eingereichten Belege, digital und an einem Ort.

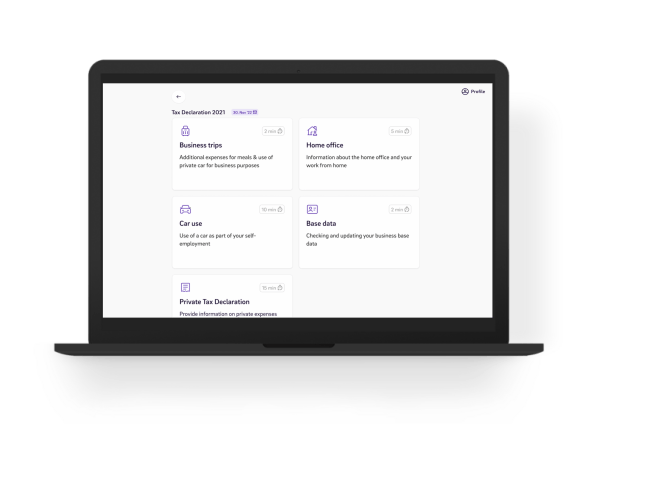

Steuererklärung ohne Stress – digital, zuverlässig und on-time

Jede deiner Ausgaben wird von uns berücksichtigt.

Ordnungsgemäße EÜR, Einkommen-, Umsatz- und Gewerbesteuererklärung.

Reiche ganz einfach Infos und Dokumente in deiner Kontist App ein.

Unsere Steuerberater*innen erledigen deine Steuererklärungen fristgerecht.

Sicherheit in Steuersachen – unsere Steuerprofis wissen, was du brauchst

Auf Selbstständige spezialisierte Steuerberater*innen.

Zugang zu professioneller Steuerberatung. Mehr dazu in den FAQs.

Gemeinsam optimieren wir deine Steuerangelegeheiten.

Erhalte einen Rundum Check deiner steuerlichen Situation in unserem verbindlichen Erstgespräch mit Profis.

Tausende Selbstständige vertrauen auf die Kontist Steuerberatung.

Das Beste an Kontist ist, dass ich bei jedem Umsatz sofort sehe, wie viel für mich übrigbleibt und wie viel an das Finanzamt geht. So bleiben böse Überraschungen bei der Steuererklärung erspart.

Ich fühle mich hier bestens aufgehoben und kann Kontist von ganzen Herzen weiterempfehlen.

Bin durch eure YouTube-Videos auf euch gestoßen und bin begeistert wie sympatisch und kompetent ihr Steuerwissen vermittelt. Ich feiere euch!

coole app mit tollen simplen funktionen! für mich ist alles total übersichtlich geworden! mit vorsteuerzahlungen hab ich keine probleme mehr! die kontist app kann ich freelancern auf jeden fall bedenkenlos weitermepfehlen!

Kontist macht Steuern einfach. Bin begeistert. Kann ich zu 100% für IT Freelancer weiterempfehlen.

Alle Zahlungseingänge kann ich einfach und schnell zuordnen, die Steuerbeträge werden gleich von der App festgelegt. Super, dass ich mir für die Steuern nicht mehr stundenlang den Kopf zerbrechen muss! Sehr praktische App!

Tausende Selbstständige vertrauen auf die Kontist Steuerberatung.

Häufig gestellte Fragen. Gerne beantwortet.

Wer kann den Steuerservice nutzen?

Derzeit können wir dir den Kontist Steuerservice nur anbieten, wenn du solo-selbstständige*r Freiberufler*in, Einzelunternehmer*in oder Gewerbetreibend*e bist. (Keine AG, GbR, GmbH, KG, Ltd., OHG, oder UG).

Außerdem gelten zur Zeit die folgenden Richtlinien:

- keine Bareinnahmen,

- keine Tätigkeit mit dem Verkauf und Versand physischer Waren,

- keine Mehrfachselbstständigkeit (mehrere Steuernummern o. Mehrere EÜRs erforderlich),

- keine Bilanzierer*innen,

- keine Steuervermeidungsmodelle

Wir behalten uns aus internen Verwaltungsgründen außerdem vor, bestimmte Berufsgruppen bzw. Branchen vom Kontist Steuerservice auszunehmen. Dazu gehören Handwerker*innen, Reinigungskräfte, Künstler*innen, Gastronomen und englischsprachige Gründer*innen.

Ist das Kontist Geschäftskonto verpflichtend?

Der Kontist Steuerservice ist nur verfügbar für solo-selbstständige Kontist-Premium-Kunden, die Kontist als ihr primäres Geschäftskonto nutzen.

Wenn du noch kein Kontist Premium-Konto hast, ist das Upgrade auf Premium im Preis inbegriffen.

Wie funktioniert der Steuerservice?

Unser Steuerservice unterstützt dich bei deinen steuerlichen Pflichten und nimmt dir bestimmte Aufgaben ab bzw. befähigt dich dazu, diese zu erledigen. Dennoch ist deine Mitwirkung hier essenziell.

Für einen reibungslosen Ablauf ist es wichtig, dass du dein Kontist Konto aktiv als Geschäftskonto nutzt. Vor allem benötigen wir korrekte Belege zu den einzelnen Buchungen.

Du hast verschiedene Möglichkeiten, uns deine Belege zukommen zu lassen.

Außerdem: Wir kommunizieren hauptsächlich per Mail mit dir. Also bitte achte auf unsere Mails in deinem Posteingang.

Welche Leistungen sind inklusive?

In unserem Preisverzeichnis siehst du ganz genau, was alles in deinem Pauschalpreis an Leistungen enthalten ist.

Die zusätzlich buchbaren Leistungen haben entweder Stückpreise oder werden im Halbstundentakt abgerechnet. Bereitest du dich auf extra Beratungsstunden gut vor, z.B. mit unseren YouTube Videos oder unserem Helpcenter, verkürzt du ggf. die benötigte Zeit.

Was bedeutet “Kommunikation mit dem Finanzamt”?

Zu Beginn deiner Mandatschaft unterzeichnest du eine Vertretungsvollmacht in deiner Kontist App. Diese hinterlegen wir bei deinem zuständigen Finanzamt. Das bedeutet wir vertreten dich bei der Kommunikation gegenüber dem Finanzamt.

Das Finanzamt richtet sich daher an uns, wenn es etwas zu besprechen gibt.

Sofern wir deine Mitarbeit benötigen, melden wir uns bei dir mit den nächsten möglichen Schritten.

Was beinhaltet die Steuerberatung?

Die Steuerberatung in deinem Pauschalpreis umfasst folgende Themen:

- häusliches Arbeitszimmer/ Homeoffice,

- Absetzbarkeit Reisekosten,

- PKW Versteuerung,

- Rechnungsstellung,

- Anlagevermögen & Abschreibung.

Andere steuerliche Beratungsthemen stellen eine kostenpflichtige Zusatzleistung dar. Unser Pool an erfahrenen Steuerberater*innen steht dir dafür gern zur Verfügung.

Wie ist die Kündigungsfrist?

Du kannst deine schriftliche Kündigung per Chat oder E-Mail einreichen. Die Zahlung der gesamten Jahresgebühr ist die Grundvoraussetzung für die Erstellung der Steuererklärungen. Daher ist die Kündigung jeweils zum Jahresende einzureichen.

Deine Daten werden dafür das ganze Jahr über gesammelt.