New Year, New Tax Calendar: everything freelancers and the self employed need to know for 2022

Last updated on Jan 20, 2022

Kate Bailey

Freelance Editor

Jan 20, 2022

Every new year is a new financial calendar year in Germany, which many expats may note is different to their home countries. As with every year, we at Kontist want to make sure freelancers and the self-employed are totally prepared for year, deadlines and their tax responsibilities by giving you a full overview of the German tax calender for 2022.

This blog post will summarise and highlight everything freelancers and the self-employed need to have in mind, starting off 2022!

On the 20 December, 2021 the German Ministry for Finances published a complete guide to the upcoming changes that would come into effect on 01 January 2022. Let’s get started with a quick review of their official announcement, obviously focused on the self-employed or those with a mix of employed and freelancer activity.

The basic allowance will be increased.

The so-called subsistence level must be tax-free for everyone. For this, there is the basic tax allowance for income tax. The federal government is taking into account the increased cost of living in Germany. The maximum amount for the deduction of maintenance payments will also be increased accordingly from January 1, 2022.

Salary increases/ income increases will not be impacted by taxes rises in certain cases

A salary increase, i.e. a wage increase, should also make itself felt in the purse of employees. Therefore, the income tax rate for the year 2022 will be adjusted to offset the effect of the so-called "cold progression". That means: wages and salaries are not taxed higher, provided that their increase only compensates for inflation.

Tax-free bonus can still be paid

In order to take into account the often more difficult conditions in the pandemic, the federal government has given employers a special allowance for their employees: Bonus payments (grants and support) of up to 1,500 EUR have been available since March 1st be paid out tax-free in 2020. This rule applies until March 31, 2022.

Corona aid is being extended

Companies and self-employed persons can take advantage of extensive support with the extension of corona aid until the end of March 2022 if they suffer from corona-related restrictions:

- Bridging aid IV for companies and self-employed people: up to 90 percent reimbursement of fixed costs

- Improved equity subsidy for companies that are particularly hard hit by corona-related closings

- Restart aid for self-employed people: continue to receive up to 1,500 euros per month in direct grants.

In addition, significant special regulations for short-time work allowance apply until March 31, 2022. In addition, the application deadline for the KfW special program has been extended to April 30, 2022 and the applicable credit limits have been increased again. This means that the program is available to companies of all sizes and from all sectors to cover their liquidity needs. For more information on Corona help, please look to the Kontist blog.

More time for planned investments

If smaller companies are planning to purchase machines or similar within the next three years , they can use the so-called investment deduction amount to deduct part of the costs when calculating profits. Due to the corona crisis, however, many companies were unable to invest as planned, which is why they were threatened with retroactive processing of the investment deduction amount after the three-year period had expired.

An extension to the end of 2021 has therefore already been agreed for preferential investments with a deadline until the end of 2020. This deadline will now be extended by another year to the end of 2022. In this way, companies can catch up on their investments without negative tax consequences.

For the self-employed who may own property, or were thinking of purchase in 2022

On January 1, 2025, the new real estate tax will come into force as an unbureaucratic, fair and constitutional regulation. This means that the unit values as the previous basis for calculating property tax will also lose their validity. The property tax value then takes its place in all federal states that have not made any deviating regulations.

It is determined by the responsible tax office on the basis of a few pieces of information that property owners communicate to their tax office. The reference date for the status of this information is January 1, 2022. However, owners do not have to do anything on this date. We will likely be informed by a public announcement at the end of March 2022.

Pension expenses are more deductible

Pension expenses from the basic pension can be deducted from tax as special expenses up to a certain maximum amount. The basic pension includes, among other things, the contributions to the statutory pension insurance, for professional pension institutions and the so-called Rürup pension. In the coming year, these expenses can be better deducted, according to the taxpayers' association. Accordingly, a slightly lower maximum amount of 25,639 EUR.

The deadline for filing the 2020 tax return has been extended

If taxpayers have their declaration for the year 2020 prepared by a tax advisor or income tax aid association, the submission deadline will be extended to May 31, 2022. Actually, the previous date for everyone with a tax advisor was the end of February 2022. Due to the corona pandemic, capacities in many tax offices are currently very scarce, so the tax office grants three months more time.

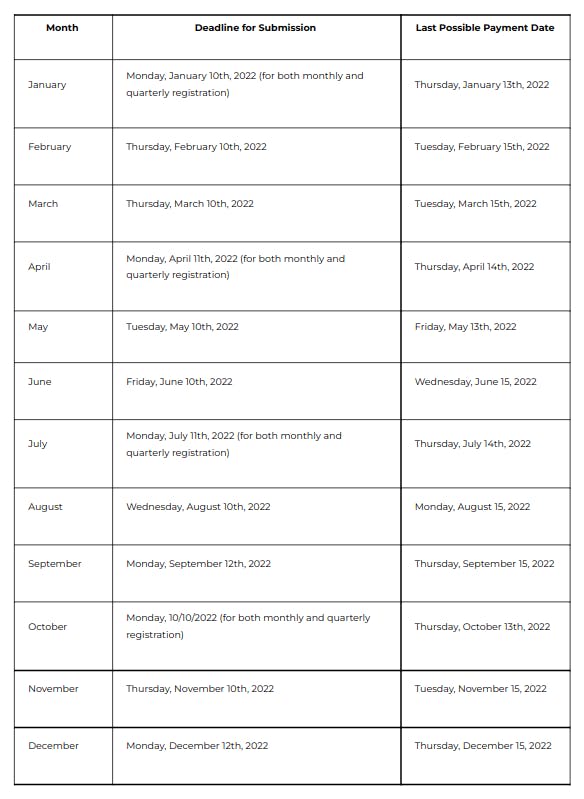

VAT (‘’Sales Tax’’) Deadlines for 2022

Of course, VAT is the ongoing responsibility of reporting your sales taxes and going through the balancing process with the Finanzamt. Not much should be changing here, and the Golden Rule remains: do not miss these deadlines!

Dates for the business tax return 2022

The trade tax is also an important tax for you as an entrepreneur in Germany. This is usually levied as trade income tax by the city or municipality in which you are based with your company. The trade tax is always 3.5 percent of your trade income, but is multiplied by the tax rate of the city or municipality. This rate of assessment can, however, differ from municipality to municipality.

But there is also another special feature. As a sole proprietorship or as people associate you an annual allowance benefit, which is 24,500 EUR. However, you always have to submit the trade tax return as part of your tax return. This can also be done automatically via ELSTER. What you need to know about collecting trade tax and what the tax rate is regulated in the trade tax law. You always have to pay trade tax as a quarterly advance payment. It is always due in the middle of a quarter.

Tax calendar for the trade tax prepayment 2022

The following dates should definitely be part of your tax calendar for 2022.

Quarterly Payment dates:

- 1st quarter 2022 Tuesday, February 15, 2022

- 2nd quarter 2022 Monday, May 16, 2022

- 3rd quarter 2022 Monday, August 15, 2022

- 4th quarter 2022 Tuesday, November 15, 2022

Dates of the income tax prepayment & corporation tax prepayment 2022

As dates for the advance payments of income tax or corporation tax, you have to note the following tax dates 2022:

- 1st quarter 2022 Thursday, March 10, 2022

- 2nd quarter 2022 Friday, June 10th 2022

- 3rd quarter 2022 Monday, September 12, 2022

- 4th quarter 2022 Monday, December 12, 2022

Deadline for filing tax returns

For the tax return there for you very clear deadlines which you must comply with. These submission deadlines concern the declarations on income tax, corporation tax, trade tax and sales tax. This submission deadline is May 31, 2022. This submission deadline is the same every year. However, you can also request an extension of the deadline.

Extension of the deadline for the tax return

These submission deadlines are automatically extended if your tax advisor carries the tax returns out for you. It can also be, for example, a tax aid association or comparable institutions. In these cases, the submission deadline is extended to December 31, 2022. If you can provide understandable reasons that you cannot meet the deadline for your tax return, you can also extend the deadline for yourself. In this case of an individual application, the tax office can extend the deadline to February 28, 2023. This extension of the deadline is really the last possible submission date.

And, WOW! That is the tax year for 2022 for freelancers and the self-employed. We hope you feel across the calendar, and also feel that even with Corona and the pandemic looming over us, you have been able to make the planning phases of the year work for you and your business!

Related articles

Freelancers - What Hourly Rate Should You Charge?

There are a lot of assumptions about Freelancers and self-employed people. Some are true - yes the freedom to make the schedule and ‘’choose’’ your clients is great. However, unlike a standard 9 to 5 job where your role is clear and defined, where the organisation you work for scales your salary and aligns it closely with specific experience and also - provides a pathway to earn more, freelancers are left to structure their income themselves as well. The assumption is - this is great, you can really charge what you are worth! However, clients tend to assume freelancers have a ‘’discounted rate’’ or that their direct rate entitles them to harsh negotiations. Quite simply, this is not the case. For freelancers, in this case, it is very important to know how much you should charge, and why - so you can negotiate your worth. In this article, we are going to take a look at what hourly rate you should be charging.

Kate Bailey

Freelance Editor